Circular design for food (CDFF) works – for nature, for farmers, for revenue. The Big Food Redesign Challenge (BFRC) proved it: by rethinking the design process to incorporate more diverse, lower-impact, and upcycled ingredients, nearly 60 companies launched products that were viable, revenue-generating, and measurably better for nature.

But for financial stakeholders and boards, one question remains: does it work for the bottom line? Scaling from isolated product wins to portfolios and supply chains means upfront costs and organisational change in a climate of mounting pressures. Without clear evidence of returns, change can appear risky, especially when margins are tight and financial cycles are short.

But the risk isn’t change, it’s standing still.

Harvests are increasingly disrupted by extreme weather, supply chains are stretched, input prices are volatile, and disclosure rules tightening. For business leaders, these translate into familiar boardroom risks: rising costs, unpredictable supply, and regulatory exposure – symptoms of a linear food system that masks long-term risks and underplays long-term value. For businesses, the choice is clear: remain vulnerable to fragile supply chains, or redesign them to be resilient, future-fit, and profitable for all.

Circular design for food (CDFF) offers a way to respond – and scaling it is the next crucial step. Doing so depends on a sharp business case that is robust, measurable, and investable.

Building a broader, evidence-backed business case

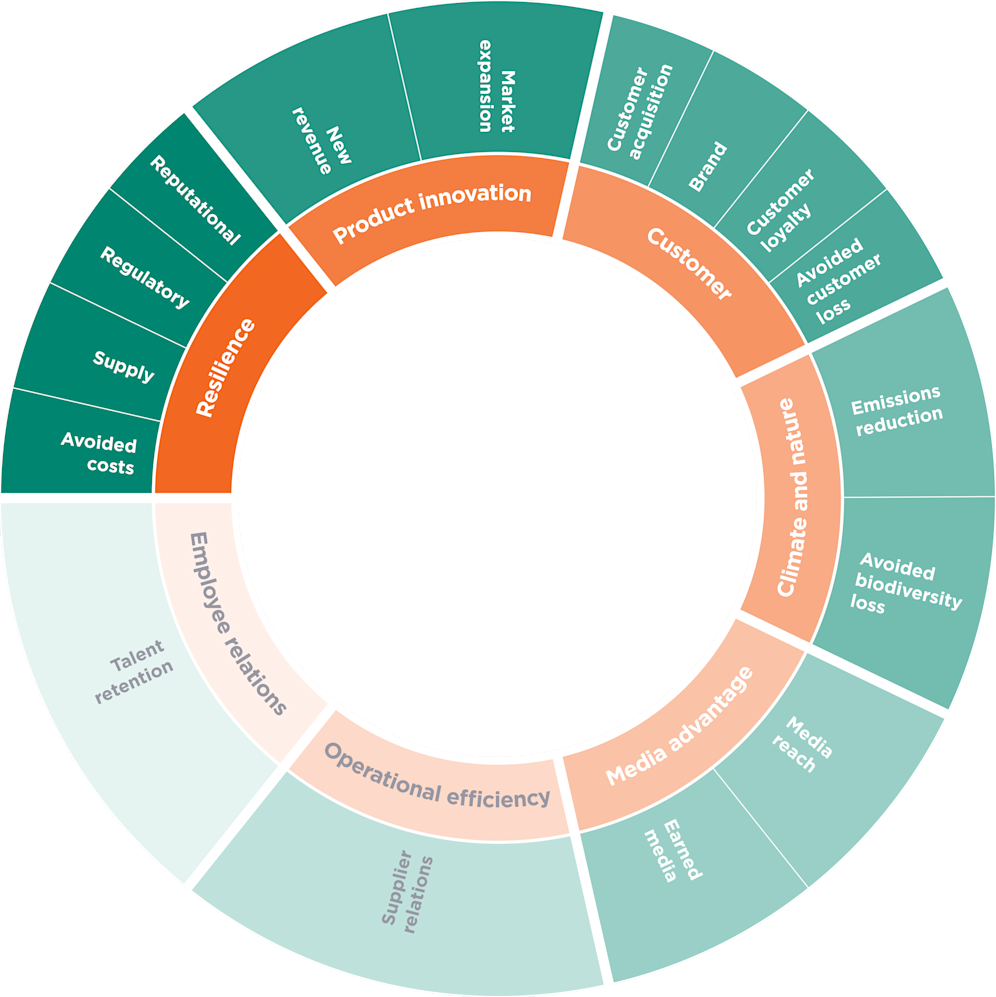

To pinpoint where lasting value lies, we worked with NYU Stern’s Center for Sustainable Business and a network of food businesses, processors, retailers, and financial institutions. Using NYU Stern’s ROSI™ (Return on Sustainability Investment) framework, we surfaced sources of business value often overlooked in conventional financial reporting – benefits that strengthen profitability and competitiveness but rarely appear on the balance sheet. Here, ‘value’ spans both direct financial gains — such as cost savings and revenue growth — and longer-term benefits like brand strength and supply chain stability that underpin competitiveness.

One message came through clearly: applying circular design strategies builds financial resilience. Thoughtful ingredient selection, underpinned by better sourcing strategies, can reduce exposure to volatile commodity markets, stabilise supply, and reduce costs – mitigating operational risk, protecting margins, and creating the conditions for growth.

How circular design strengthens financial performance and risk control

Circular design for food strengthens financial resilience in several ways. Across the businesses we spoke to, three themes stood out:

Risk mitigation

Ingredient availability and affordability are now two of the biggest risks food businesses face. Climate shocks and extreme weather are no longer occasional disruptions, they are becoming structural pressures, pushing up prices and doubling the risk of major crop failures within this decade.

Regenerative productionRegenerative productionRegenerative production provides food and materials in ways that support positive outcomes for nature, which include but are not limited to: healthy and stable soils, improved local biodiversity, improved air and water quality. is key to farm-level resilience and future supply security, but it can only scale if there is strong, consistent market demand for the crops it produces. CDFF helps create that demand by expanding the range of ingredients used in products and portfolios. Agreeing longer-term contracts also gives suppliers the security to invest in regenerative practices. Together, these shifts help de-risk the transition for farmers and build portfolio resilience for companies by diversifying their ingredient base and reducing exposure to climate and supply risks.

As Franck Saint-Martin, Environmental Impact Manager, Global Public Affairs and ESG Engagement, from Nestlé put it: “Regenerative agriculture was initially pursued to meet climate targets and net zero ambitions, but it’s now clear that it is equally about supply chain resilience. As climate change disrupts yields and challenges the reliability of existing supply chains, investing in scaling up regenerative agriculture practices as well as crop diversification is essential to sustaining business and securing access to raw materials for the future.”

Regulatory readiness is another critical dimension of financial resilience. What was once voluntary is fast becoming mandatory, with real financial risks attached: disruption, fines, or even loss of market access. Big food and agriculture companies are increasingly accountable for what happens through their supply chains, and exposed to tightening disclosure requirements on emissions, land-use, and biodiversity. Circular design strategies address the outcomes regulators are targeting – emission reductions, nature regeneration – ensuring businesses remain investable and competitive.

As exposure to physical and regulatory risks becomes more transparent, insurers and lenders are also starting to price resilience in. Businesses able to demonstrate lower supply and climate risks through circular and regenerative design can, in some cases, access preferential lending terms or lower insurance premiums — a tangible financial reward for risk reduction.

Market opportunity

Consumer demand for healthier, nutrient-dense food with clear origins and trusted sourcing is accelerating. Regeneratively grown ingredients are increasingly recognised for their higher nutritional value, giving them an edge with health-conscious consumers. Circular design goes further, combining regenerative, more diverse ingredients in new ways that fill dietary gaps and build consumer trust, helping brands strengthen differentiation and capture market share.

Reformulation offers a practical way to update existing lines, keeping them relevant without sacrificing taste or cannibalising sales. NotCo’s Giuseppe AI, for example, enabled Kraft Heinz to reformulate its Mac & Cheese with 100% plant-based ingredients – maintaining taste while overcoming R&D bottlenecks.

First-mover advantage is emerging as a defining differentiator for businesses. Retailers are setting ambitious climate and sourcing commitments, and they want partners whose products can help deliver them. Companies that act early can secure stronger partnerships and reinforce brand positioning. Waitrose’s partnership with Wildfarmed is a case in point: it advanced Waitrose’s sustainability goals and reinforced its brand values while giving Wildfarmed a platform to bring regenerative agriculture to consumers nationwide. As Danone’s Roxane Clement, Global Dairy Category Sustainability Director, put it: “If we’re not first to market and capturing the benefits of a new proposition, whether from a retailer or consumer perspective, that potential loss becomes an integral part of our business case.”

Revenue potential

Circular design creates value on both sides of the ledger. By upcycling by-products into high-value ingredients, businesses not only unlock new revenue streams but also reduce waste costs. Tetra Pak, for example, has developed a process to transform brewer’s spent grain – once used for animal feed – into a high-protein ingredient representing a USD 3 billion opportunity by 2030. Brands like Rescued are showing how this approach works in everyday categories, upcycling tomatoes and bread into new products that reduce losses for retailers, create new income streams for farmers, and create new product lines.

By cutting costs and creating revenue, circular design builds a healthier bottom line.

Making the business case investment-ready

Even with a strong commercial rationale, scaling circular design requires capital. Both CFOs and investors need confidence that circular design for food will drive clear return on investment (ROI). Translating design strategies into clear, quantifiable outcomes, such as cash flow projections, risk profiles, and expected returns is key to gaining traction with financial decision makers.

Insights from this project show that capital often fails to flow because of a lack of clarity on what, exactly, needs to be financed across the value chain – from large brands investing in redesigning their own products, to retooling food processing infrastructure, to incentivising farmers to boost biodiversity among crop rotations. Progress depends on bringing the right value chain stakeholders to the table and aligning them with the right type of capital at the right time.

Some initiatives are already closing this financing gap. In the US Midwest, the TransCap project is prototyping a ‘capital orchestrator’, designed to align and deploy multiple forms of capital across the value chain to enable regenerative production. Others, like McCain’s global regenerative agriculture programme, shows what’s possible when capital flows: by partnering with the likes of AGCO and Rabobank, it has provided potato farmers with training and flexible finance, making improved farm practices both viable and investable. Together, these examples highlight a growing trend of financial institutions rewarding resilience and sustainability performance with preferential lending terms or lower costs of capital.

The lesson is clear: businesses that can articulate a coherent picture of investment requirements, evidenced with robust data, clear financial return projections, and measurable outcomes will be better placed to secure capital to scale circular design from pilot to portfolio.

The value map illustrates where circular design metrics translate into measurable business value, as detailed in the table below.

A tool to sharpen the business case

Scaling circular design requires credible evidence that investors and boards can act on. To support decision-makers across the food value chain, we, together with input from NYU Stern’s Center for Sustainable Business, have mapped 40 metrics that outline the value of circular design strategies. These include quantifiable financial benefits, such as new revenue streams or avoided costs, and broader benefits tied to overall business performance, such as brand strength or supplier relations.

While the value of regenerative production is increasingly clear at the farm level and across supply chains, the added benefits come when these practices underpin thoughtful ingredient choices – more diverse, lower-impact, and upcycled ingredients. Connecting design choices upstream to processing, logistics, retail, and finance functions shows how farm-level resilience can translate into business resilience.

The most appropriate metrics depend on where an organisation sits in the value chain and which levers it can most effectively pull. For brands and manufacturers, avoided costs may be most compelling, for retailers, sales growth from new products may carry greater weight. Using the full suite of metrics – which is by no means exhaustive – allows organisations to identify which data points best align with their strategic priorities, helping to build a stronger, evidence-based business case for investment and scale.

Not every organisation will have access to the same depth of data. For smaller brands, gathering consistent information across suppliers can be difficult, making it harder to build a fully quantified case. The goal is to begin where the data are strongest and strengthen the evidence base as systems mature.

What else helps?

Inside companies, five catalysts stood out:

Focus on where you can shift the system: COOK’s ‘recipe for change’ lasagne tackles one of its biggest climate levers: beef. By sourcing regenerative beef, the company creates steady demand that helps farmers invest in adapting their practices, making regenerative options more accessible over time. Meanwhile, recipe reformulations with lentils and mushrooms reduce emissions today while maintaining the same price point. The result is climate action that aligns with taste, affordability, and brand values.

Design with suppliers in the room: the strongest results come from a whole supply chain approach. Involving farmers and agronomists directly ensures innovations are practical, scalable, and rooted in real-world agricultural contexts.

Create the right innovation environment: Organisational structure matters. Innovation needs a mandate, so businesses that create space for experimentation and break down siloes between R&D, procurement, marketing, and finance are better placed to embed circular design strategies.

Strengthen data systems: Too often, information on sourcing, product performance, or supplier practices is incomplete or fragmented across functions, leaving teams with “unknown unknowns”. Investing in better data improves collaboration, sharpens decision-making, and makes the case for change more compelling.

Treat it as transformation, not a project: Embedding circular design at scale requires coordinated change across functions — procurement, R&D, finance, and marketing. Businesses that treat it as a system-wide shift, with dedicated change management and leadership buy-in, make progress faster and more sustainably. This lesson is echoed in our ‘How not to fail’ report, which draws insights from 30+ companies spanning various sectors that have worked to bring circular economycircular economyA systems solution framework that tackles global challenges like climate change, biodiversity loss, waste, and pollution. It is based on three principles, driven by design: eliminate waste and pollution, circulate products and materials (at their highest value), and regenerate nature. solutions to scale.